Related Articles

Isaac Newton and Bitcoin

The problem with all investments and, more pertinently, investors, is that judgements are not necessarily based on reason and value.

Falling off the Shoulder of Giants

The recent plunge in the global stock markets have given a reminder to all investors that ‘stocks may fall as well as rise’. It is a message that is seemingly forgotten every day and has been so for as long as investment has been in existence.

The problem with all investments and, more pertinently, investors, is that judgements are not necessarily based on reason and value. As we will see, one of the greatest minds in history didn’t learn that lesson.

.

Bitcoin: What Goes Up

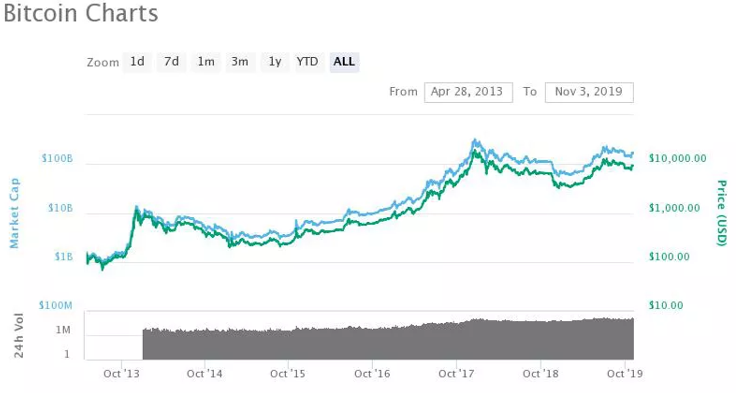

In 2010, you could buy Bitcoin for $0.05. In 2015, you could buy it for $220. At the end of last year, its price had crept up to almost $1,000. At the beginning of this year, the price reached $18,000.

The Bitcoin price graph displays the vertical take-off pattern normally seen towards the end of a financial bubble. The biggest gains can be made towards the end of an asset price bubble just when investing in the bubble is at its most dangerous.

The underlying features of the asset which is the object of a financial bubble almost don’t matter. Of far more importance is the presence of those human characteristics of greed (and wanting to get rich quickly) and fear (of missing out as friends and neighbours get rich while you’re left behind).

.

The more things change, the more they stay the same

The South Sea Company was a London company was granted a British government monopoly to trade with South America. It was set up as a public-private partnership in 1711 to reduce the cost of national debt. The problem was that Spain controlled South America and there was therefore little realistic prospect that trade would take place. The company never generated any significant profit from its monopoly. That didn’t stop it becoming the object of a massive financial bubble.

The Swiss investment manager Marc Faber has prepared a wonderful graphic illustrating how the great scientist Isaac Newton lost his fortune investing in South Sea Company shares.

Against the backdrop of the sharp rise and fall of the company’s share price, Faber has marked Newton’s transactions: at the start of the bubble “Newton invests a bit; after seeing the value of his investment more than double “Newton exits happy”; as prices continue to rise “Newton’s friends get rich”; at a price double that where he sold “Newton re-enters with a lot”; and, finally, at a much lower price after the bubble had burst “Newton exits broke”.

You might forgive the great man on the grounds that he was a scientist with his head in the clouds but, throughout this time, Newton was a financial market insider in charge of the British Mint.

Cormac Lucey is an IMI associate on the IMI Diploma in Business Finance. Cormac is also a Financial Services Consultant and Contractor who has previously worked with PricewaterhouseCoopers, Rabobank Frankfurt and the Department of Justice.